Annual Laser Market Review & Forecast: Where have all the lasers gone?

01/23/2017

Laser companies both small and large are feeling the recent surge of techsector M&A activity. Whether a timetomarket or portfolio expansion play, the details reveal much about where the laser industry is headed in the next decade—notwithstanding surprises related to Brexit or U.S. elections.

GAIL OVERTON, ALLEN NOGEE, DAVID BELFORTE, and CONARD HOLTON

Once considered a solution in search of a problem, the laser has become an important tool forging the next generation of innovative technologies¹. And while many laser manufacturers are content to focus on a pureplay laser portfolio and trump the worldwide economic slowdown ² with midsingledigit sales growth, many laser—and increasingly, nonlaser—companies are keen to leverage the intellectual property (IP) value of laser technology and speed time to market.

Unfortunately, it becomes more difficult to forecast pure laser sales when a laser is just one component of a vertical or upstream systems offering. The laser revenue gets lost in the shuffle, especially when quarterly financial statements from multinational conglomerates seldom call out the product or technology mix that contributes to the bottomline numbers.

So, where have all the lasers gone? Whether part of a technology portfolio acquired by a nonlaser company seeking IP differentiation and timetomarket leverage, absorbed by another pureplay laser manufacturer looking to grow its product portfolio, or remaining intact as a noncommodity specialty product that meets niche market demands, you can bet that lasers are coming to an airport, hardware store, holiday display, theatre, auto dealership, or dental/medical office near you.

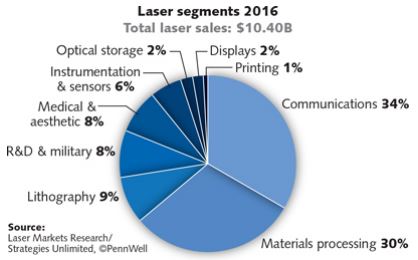

For all that they do, lasers will continue to be instrumental in existing and emerging markets worldwide that will, by our estimates, grow laser sales to nearly $11.1 billion in 2017—a roughly 6.6% increase from the revised $10.4 billion in sales for 2016. The secret is out: laserenabled technologies are big business, and some companies are ripe for picking.

"Market consolidation is normal when products mature and enter commodity status," says Markus Röhner, director of sales in the Healthcare Business Unit of Jenoptik (Jena, Germany), whose laser segment is focused on diode and ultrafast lasers for automotive, medical technology, and materials processing applications. "Economic growth rates have been stuck at a few percent in the last few years and in order to increase sales and revenue, entering new markets is appealing. Even though product complexity has increased over the last few decades, there is pressure to shorten development times for new technologies—contrary trends that impose 'make or buy' decisions crucial to a smart development strategy."

Consider what has happened to light detection and ranging (lidar) laser technologies, for example. "In August of 2016, lidar company Quanergy Systems joined autonomous robotics startup Zoox as a member of the billiondollarvaluation unicorn club, Ford and Chinese Internet company Baidu invested $150 million in Velodyne,³ and in October 2016, Infineon complemented its radar IC portfolio with MEMS chips for solidstate laser lidar by acquiring Innoluce," says Alex Lidow, founder and CEO of Efficient Power Conversion Corporation (EPC; El Segundo, CA), manufacturer of galliumnitride (GaN) power semiconductors that enable lasers to emit and detect photons 100X faster than silicon devices for centimeter ranging resolution. "It's no secret that lidar has emerged as one of the hottest laserenabled technologies in recent memory, but what is surprising is how rapidly—a short 2 to 3 years—the technology went from Googlecar curiosity to mainstream driverassist implementation."

There is a reason lidar is becoming ubiquitous.4 The ranging capability of lasers cannot be matched by visual camera technologycase in point: the Tesla car on Autopilot could have seen that semitrailer truck and avoided the tragic collision that made headlines in late June 2016 had it been equipped with a lidar system.5

Despite this consumer setback, Lidow predicts that merger and acquisition (M&A) activity in the autonomous vehicle market will continue as companies seek to differentiate their lidar systems offering and enter the market faster with lowercost lidar options. In fact, the Cars 2025: Vol. 3 Global Investment Research report from the Goldman Sachs Group (New York, NY) entitled "Monetizing the rise of Autonomous Vehicles"6 predicts that lidar will be a $10.6 billion—yes, billion—market by 2025.

In August 2016, Bloomberg (New York, NY) reported that Uber's acquisition of selfdriving technology company Otto7 would allow Uber to replace its 100 million human drivers with robot drivers as quickly as possible. Lidow sees lidar as the sensor of choice not only for selfdriving cars and driver assistance, but also for drone navigation and autonomous industrial robotics.

Laser revenues and 2017 forecast

"Whenever you hear the word 'autonomy,' you can bet that optical sensing technology will be key and photons will be running around somewhere," says Mark Bendett, strategist in the Advanced Technology Laboratories of Lockheed Martin (Cherry Hill, NJ). Bendett argues that the investment, consolidation, and M&A activity in the lidar sector is consistent with the maturity, commoditization, and reliability of laser technology—whether in the defense, medical, or industrial markets. "Directedenergy weapons are moving from R&D experiments to realworld deployment on ships as well as on other ground and air defense systems, and ultrafast lasers are the workhorses of ophthalmology and materials processing."

But lidar and LASIK surgery didn't pop up overnight, Bendett emphasizes. "IMRA got it right with femtosecond fiber laser technology8 for ophthalmic applications in the mid1990s. Not only did they manufacture a laser that machined human tissue, they also built tens and then hundreds of lasers that each delivered identical performance parameters over and over, year after year. And in 19921997, they prototyped autonomous vehicle lidar systems that are just now cheap enough and reliable enough for implementation on a commercial scale," he adds.

"Laser technology seems to come out in bursts, but markets are driven by the dollar. Even though 3D holograms9 were neat to laser technologists decades ago, the flatscreen experience will only be replaced with something like holographic television when the technology is costeffective for the masses," says Bendett. "Lidar has finally arrived as $80,000 system prices have dropped to $8000 and soon to just hundreds of dollars. The flurry of laser M&A activity in the lidar sector is following a historic progression wherein the 'invention' stage of a technology is replaced by a 'reliability, incremental improvement, and costreduction' stage."

M&A on the march

Merger & acquisition activity in the laser industry is not a new phenomenon, but for 2015/2016, it is poised to reach alltime highs for a variety of reasons. Since the dotcom and telecom collapses in 2000/200110 and the great recession of 2008/2009,11 Financier Worldwide (Birmingham, England) reports12 that as of the first quarter of 2015, "tech sector M&A has continued to set new postdotcombubble highs for both quarterly value and volume."

Summarizing its M&A Trends Report 2016, Deloitte (New York, NY) adds,13 "By sector, technology continues to be the most attractive overall industry for both corporate and private equity investor M&A activity in the next 12 months. No surprise, because boundaries are increasingly blurring between industry sectors as technology penetrates and reshapes traditional business models."

The penetration of lidar technology into the autonomous vehicle sector has definitely reshaped how auto manufacturers and defense system providers view laser lidar suppliers—namely, small companies are getting big investment dollars. And similar things are happening in materials processing and medical: big international companies have decided that laserenabled systems can have profound bottomlinebeneficial consumer and industrial implications.

"We are in inning one of the lidar game; expect more players to enter with better products and deeper IP, as well as more alliances, deals, and many more dollars to flow," says John Dexheimer, president of LightWave Advisors (Westport, CT). "The auto firms want and need lidar now or risk being an alsoran or mere buyer of products and not a designer or 'big data source'—after all, lidar is not just devices, but an important part of an architecture that integrates hardware, software, artificial intelligence, and data analytics to repurpose the car or drone into a sensorrich, mobile computer linked to the cloud."

Swimming upstream

In addition to lidar, Dexheimer sees laser additive manufacturing (AM) as another hub of M&A activity upstream from the laser itself, with much larger market potential than devices alone. Like lidar, AM is enabled by laser devices, but represents a complete system offering that allows a company to play across multiple industries and again, provide datarich or digital interconnectedness capabilities for its endusers.

Interconnectedness is embodied in the concepts of Industry 4.0,14 the new catchphrase being embraced across the manufacturing community. In fact, Trumpf (Ditzingen, Germany) revealed in its 2015/2016 Annual Report15 that it had modeled its TruLaser Center 7030 after the principles of Industry 4.0 and also has a smart factory under construction in Chicago that intends to "...connect already existing machines and software systems with each other, with workpieces and with people... to demonstrate completely new business models."

About the numbers

The estimates and forecasts of laser revenue are based on both supply and demand side analyses by Allen Nogee, president of Laser Markets Research, for Strategies Unlimited, a PennWell business that has been conducting market research in photonics for more than 30 years. The research considered both quarterly and longterm historical trends—results were then compared and adjusted to correct for known errors. Significantly more information is presented each year at the Lasers & Photonics Marketplace Seminar (www.marketplaceseminar.com), held in conjunction with SPIE Photonics West, and in the annual Worldwide Market for Lasers: Market Review and Forecast, available from Strategies Unlimited in March 2017 (www.strategiesu.com).

This digital interconnectedness ambition is also pivotal for General Electric (GE; Boston, MA)—now proclaimed on its website to be "The world's premier digital industrial company"—and described in the KPMG (Amsterdam, Netherlands) 2016 Global Manufacturing Outlook16 as the ability to harness the petabytes of data from its products to create customer value. For example, a regular maintenance schedule on an aircraft engine can be replaced by realtime monitoring using laser sensors that identify issues as they happen, and addressed immediately with 3Dprinted parts.

General Electric just placed a $73 million R&D center next to its 48year old turbine plant17 in Greenville, SC to expedite new product development. This Advanced Manufacturing Works has a front showroom for manufacturing technologies that GE is testing, including 3D printers, lasers, and robotic arms. Already, the first fruitful outcome has been a 3D direct metal laser machining (DMLM) turbine component18 manufactured using SLM Solutions Group (Lübeck, Germany) Selective Laser Melting (SLM [trademarked]) systems.

At the 2016 formnext conference in Frankfurt, Germany, which is turning out to be one of the largest additive manufacturing and 3D printing events19 as evidenced by its 300+ exhibitors and 13,000+ attendees, GE announced its bold plans to leverage its $1.5 billion additive manufacturing investment in its Niskayuna, NY Global Research Center to create GE Additive and grow the business to $1 billion by 2020. And after an unsuccessful attempt to acquire SLM because a dissident shareholder blocked its bid as too low, GE raised its bid to purchase Swedish 3D printer maker Arcam20 and then acquired a 75% stake21 in laser AM pioneer Concept Laser (Lichtenfels, Germany) and its branded LaserCUSING technology in late 2016 for nearly $600 million.

"In this case, GE is buying both a strategic need for its own processing capability and a growth market. Plus the idea of scarcity came into play—there just are not many metals additive firms with significant success or technical IPdepth and talent. The combination of all three elements allows these laser AM firms to trade at much higher multiples compared to 'just laser' firms," Dexheimer adds.

"GE's bid for Arcam and offering for Concept Laser were both at about 8X annual revenue—much greater multiples than any laser firm: more than IPG's public value multiple of 45X revenue, much more than the buyout value metric for Rofin and Newport of about 1.5X revenue, and more than Coherent's value metrics, even though COHR stock has doubled since the Rofin deal was announced."

"On Newport and Rofin"—namely, the acquisition of Newport Corporation (Irvine, CA)22 by MKS Instruments (Andover, MA) in early 2016 for $980M and the $942M acquisition of RofinSinar (Hamburg, Germany and Plymouth, MI)23 by Coherent (Santa Clara, CA)—"neither deal was surprising," Dexheimer concludes. "Both companies had low or no internal growth, were prone to a leveraged buyout for a private equity group, had divestible business units, and corporate overheads that made savings via integration into Coherent and MKS readily doable as ways to increase profitability."

Remember Newport Corporation's (Irvine, CA) 2004 pregreatrecession acquisition of SpectraPhysics and its 2011 and 2014/2015 postgreatrecession acquisitions of High Q Laser and VGen/Femtolasers PRODUKTIONS, respectively, all with the realized goal of helping to grow Newport's laser offerings and annual sales from nearly $404 million in 2005 (including SpectraPhysics)24 to nearly $603 million in 2015?25 It seems all those pureplay laser acquisitions grew Newport into an attractive photonics systems solutions provider that caught the eye of technology solutions provider MKS Instruments.

Ironically, however, as it pertains to lasers, "The Newport acquisition was a good deal for the buyer; MKS could sell SpectraPhysics, the least profitable part of the business, to other laser firms as part of its estimated $35milliondollar annual cost synergies," Dexheimer adds. After all, MKS says it saw an opportunity26 via the Newport acquisition to "pursue sustained profitable growth by expanding into adjacent markets while increasing our served addressable market in our core semiconductor business." In this case, MKS was after more than just pure laser technology.

Echoed in a Zacks market prediction,27 "The company [MKS] has acquired Newport Corporation to provide superior integrated solutions for lithography modules & systems and inspection in the near term" and is poised to benefit from a solid semiconductor upturn, which is now likely: in November 2016, SEMI (www.semi.org) announced that thirdquarter 2016 silicon wafer shipments28 reached an alltime high and predicts that fabrication equipment spending29 will grow 4.1 % in 2016 and 10.6% in 2017.

Coherent also stands to benefit from an improving semiconductor fabrication outlook. For its Q3 ended October 1, 2016, Coherent's microelectronics market revenue30 reached $144.2 milliona significant improvement from the $112.1 million reached in the same quarter of 2015 and a factor of 3 to 5 larger than its OEM components and instrumentation, materials processing, and scientific and government market sales for the same Q3 2016 of $42.5, $36.4, and $25.3 million, respectively.

Much of Coherent's recent success and strong bookings position is attributed to some very large sales of excimer lasers for annealing processes in flatpanel display manufacture, as well as success in ophthalmic lasers, lasers for additive manufacturing and carbonfiber reinforced plastic cutting, and ultrafast lasers for strengthenedglass cutting (continued interest in the latter laser type is exemplified by the fact that the top downloaded paper in Optics Letters31 in 2016 was ICFO's "High power multicolor OPCPA source with simultaneous femtosecond deepUV to midIR outputs"). The RofinSinar acquisition should take Coherent beyond billiondollar territory in 2017.

"Coherent and Rofin are highly complementary both geographically and technologically, and together we can increase efficiencies, leverage the scale of the combined businesses, and strengthen research and development," says Thomas Merk, senior VP & GM of Coherent's Industrial Laser Systems Unit and former CEO of RofinSinar. "The Coherent and Rofin combination represents a unique opportunity to create the world's most comprehensive product portfolio in lasers and photonicsbased technologies and solutions."

Just like Coherent, whose stock price doubled from an average $60 from 2014 through 2016 to more than $120 as of November 2016, semiconductor laser manufacturer IIVI (Pittsburgh, PA) also saw its stock double from $14 lows in early 2015 to $28 in late 2016 following its early 2016 acquisitions32 of epitaxial wafer house EpiWorks (Champaign, IL) and galliumarsenide (GaAs) pioneer Anadigics (Warren, NJ), as well as its October 2016 acquisition of Direct Photonics (Berlin, Germany). Concerning the latter acquisition, "The main advantage for Direct Photonics[33] will [be] the vertical integration of our supply chain, so that all of the optical components needed for our direct diode lasers can now be sourced internally, which will mean dramatic cost reductions. So we will be more competitive."

"With stronger performance than even IPG stock [which has hovered around $2022 in the past two years], the market has liked these deals and the economic projections resulting from them," Dexheimer concludes. "The move to consolidate/integrate and grow the product base is at least near term, what Wall Street wants to see." And yet, we at Laser Focus World wonder whether what's good for Wall Street will be good for Main Street, as the saying goes.

Economic indifference

In June 2016, the World Bank published the silver anniversary edition of its Global Economic Prospects report, and the news was not encouraging.34 Expected 2016 global growth of 2.4% was 0.5% lower than its January 2016 report, primarily citing declines in commodity prices, weak global trade and manufacturing activity in advanced economies with highdebtlevel/lowinterestrate policies (that leave no cushion if productivity continues to fall), and increased political uncertainty such as Brexit35 and a Trump presidency.

In a postBrexit report36 from Optics & Photonics News (OPN; Washington, DC), OSA (Washington, DC) senior industry adviser Tom Hausken says that while there will be nearterm "ripple effects" such as a fall in the British pound exchange rate and shortage of UK technology workers if labor exchange is stifled, the UK represents just 22% of the total European photonics workforce and receives only around 11% of European Union research funding, meaning that Brexit will largely impact the UK itself and not the rest of the world.

On the subject of a Trump presidency,37 Hausken says, "More than 90% of optics and photonics companies are small enterprises, but the large global companies earn over 80% of the revenue and may see the most disruption if global trade is impacted; however, the key word is 'if', meaning that the supertanker ship of state called the U.S. federal government doesn't make sharp turns." Hausken concludes, "It's an axiom of market and technology forecasting that we tend to overestimate the shortterm response and underestimate the longterm response. The dividends of a Trump presidency won't likely be as strong as Trump supporters think, and they won't be as dire as Clinton supporters think. The overall impact to the laser industry will take time to play out."

Regardless of what Brexit and the Trump presidency adds to or subtracts from the global economy, the World Bank report predicts <2% growth in Europe, the U.S., and Japan, and only 6.7% growth in China for 2016. Fortunately, as we predicted last year, laser sales exceeded the global economic growth rate in 2016, and most laser manufacturers we spoke with are indifferent to the slowtostagnant new normal of the economy and instead are happy to focus on thriving and emerging laser applications. The population continues to age which improves medical laser sales, automation and 'smart' technologies require more laserbased sensors and 3Dprinted components, and Internet of Things (IoT) and digital communications growth is ideal for telecom laser sales and laser lithography technologies, to name a few.

The Laser Market Segments

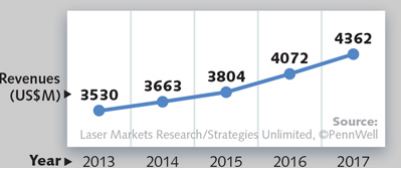

Laser revenues for materials processing and lithography were once again the largest segment in 2016 at $4.072 billion. Communications and optical storage laser sales were a close second at $3.732 billion, followed by lasers for the scientific R&D and military markets at $877 million. The remainder of the revenue pie, in order of descending sales, is lasers for medical and aesthetic applications at $838 million, instrumentation and sensor markets at $608 million, and the combined entertainment, displays, and imagerecording segments at $268 million.

Materials processing and lithography

2016 was a most unsettled time for global manufacturing. Setting aside its normal up and down cycles, concerns over Brexit, economic issues in China, and political uncertainties of the administration change in Washington gave cause for concern about growth prospects. Industrial laser activity in the global manufacturing sector, however, enjoyed another growth year led by strong doubledigit sales of highpower fiber lasers, a surge in excimer laser revenues, and significant rise in ultrafast laser applications.

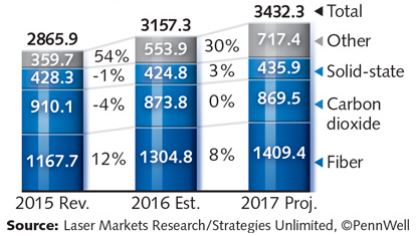

Kilowatt fiber lasers for metal cutting and joining operations represented 41% of the total industrial laser revenues in 2016. Overall, the 12% increase in fiber laser sales came in part at the expense of CO2 (4%) and solidstate (1%) lasers. On a percentage basis, highpower direct diode and excimer lasers in the Other category experienced the largest annual revenue gain (54%) in recent years. These lasers have been recording strong growth because of their limited base numbers in several of our last reports, bolstered by excimer laser annealing of silicon.

Revenues by industrial laser type ($M)

Fiber laser sales (almost 50% of totals) contributed significantly to total laser revenue growth of more than 10%. IPG Photonics' (Oxford, MA) revenues from fiber lasers could be pushing the $1 billion mark when calendar year numbers are finalized. Joining the billiondollar level will be Coherent, whose fiscal year closed at more than $857 million, assisted by strong excimer sales at the end of the year and the RofinSinar merger. Trumpf 2015/2016 revenues approached the $2.8 billion mark, with laser technology alone topping $1 billion.

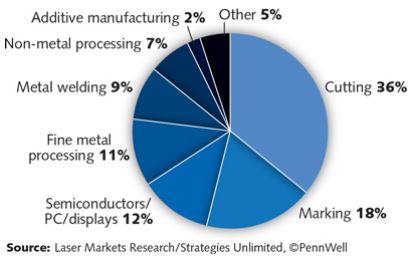

Automotive, aerospace, energy, electronics, and communications (smartphones) materials processing applications continued to drive strong industrial laser sales. Of the three major industrial laser categories, the Micro category, which includes all applications using lasers with <500 W of power, climbed to 35% of the total laser market thanks to 105% growth in the sector that included display applications requiring excimer lasersCoherent alone said in its third fiscal quarter38 ended July 2, 2016, "As expected, we received significant orders for flat panel annealing lasers including a single order in excess of $100 million." The Macro category, including laser processes requiring >500 W of power, is the largest (at 47%) of all laser revenues, thanks to fiber lasers that comprise 44% of all Macro revenues. And finally, Marking (including engraving) contributed about 18% of all laser revenues, with solid growth continuing at 3.9% dominated by fiber lasers representing 49% of total sales.

Materials processing & lithography

Includes lasers for all types of metal processing (welding, cutting, annealing, drilling); semiconductor and microelectronics manufacturing (lithography, scribing, defect repair, via drilling); marking of all materials; and other materials processing (such as cutting and welding organics, rapid prototyping or 3D printing, micromachining, and grating manufacture). Also includes lasers for lithography.

The uncertainty from Brexit, the U.S. presidential election, and Coherent's purchase of Rofin, combined with weak U.S. and European economies, did little to help sales in materials processing. The strong dollar and Euro relative to other countries only compounded the problem, and made it more expensive for other countries to import U.S. and European lasers. Low oil prices did contribute to strong automotive sales in 2016, especially light trucks and SUVs, and this helped drive sales for metal cutting.

Despite a bit of a slowdown in China, the value of lasers exported into China continues to grow. Japan and South Korea also had significant industrial laser imports in 2016. In addition to a large number of fiber lasers, many excimer lasers were also exported to Asia for the production of flatpanel displays—especially for smartphone OLED displays.

The market for lasers used for photolithography was weak in 2016, but the market for semiconductors did improve as the year progressed. Revenue for lasers used for additive manufacturing also grew in 2016, roughly by 20%.

Cutting is the most important application on two levels: revenues generated and as a user of highpower fiber lasers. This sector is key among both industrialized and emerging economies, with growth prospects closely tied to a nation's GDP. With the economy soft in 2016, cutting suffered with growth at just 3.5%. Fortuitously, global demand for laser welding (3.4%) led by the auto industry and boosted by pipeline and downhole oil pipe welding made up the difference. Nonmetal processing applications in fiberreinforced polymers combined with finemetal processing add 5% to total market growth. Additive manufacturing, more specifically laser metal deposition, grew 22.1% in 2016 spurred by acceptance in the aviation engine industry, where both intermediate and highpower CO2 and fiber lasers are used.

Laser materials processing applications 2016

Economic projections for manufacturing in 2017 are a repeat of 2016 with pockets of sluggishness (East Asia, South America, and Eastern Europe) continuing. For industrial lasers, 8.7% revenue growth is projected. Marking laser revenues are expected to show a decline as unit prices continue to erode. Micro laser revenue will grow 38% as excimer laser shipments continue and nonmetal processing grows in importance. And the Macro category levels off to 47% of 2017 total revenues, featuring 8% growth in the fiber laser segment.

Lithography laser revenues are also on the rise. Expanding upon its 2012 acquisition39 of EUV and excimer lithography lightsource maker Cymer, ASML (Veldhoven, Netherlands) also bought a 24.9% stake ($1.1 billion) in Carl Zeiss SMT (Oberkochen, Germany) in late 2016. As announced by ASML,40 "With its highperformance optics Carl Zeiss SMT supplies an essential subsystem of ASML's semiconductor lithography scanners," allowing the companies to "facilitate the development of the future generation of Extreme Ultraviolet (EUV) lithography systems due in the first few years of the next decade."

Communications and optical storage

Optical network and backhaul infrastructure installations such as 100G and WDMrich architectures are in a boom cycle: Networking component and equipment market research firm Cigna AI (Boston, MA) says that optical network systems sales41 grew 10% yearoveryear in Q3 2016 on strong 100G and coherent WDM system sales, especially in China where longhaul WDM spending grew 50% compared to the same quarter a year ago; the Telecommunications Industry Association (TIA; Arlington, VA) predicts 13.7% compound annual growth (CAGR) from 2015 to 2020 in such 'pacesetter' industries42 as cloud computing, business Ethernet, health IT, and robotics led by a 30% CAGR in IoT and network virtualization; and LightCounting (Eugene, OR) predicts that optical module and component sales43 will increase at a 10% CAGR from 2017 to 2021.

For 2016, it appears that the telecom bubble44 is history, bandwidth demand is real, and telecom lasers serving 100G markets will benefit from robust wireline installations. For example, Oclaro's (San Jose, CA) 100G component sales grew 20% for the fifth consecutive quarter, and first fiscal quarter of 2017 (ended October 1, 2016) revenues of $135.5 million45 were up sharply from the $87.6 million Oclaro reported in the same fiscal quarter last year.

Communications and optical storage laser revenues reached $3.732 billion in 2016a nice increase from the $3.442 billion reached in 2015 and primarily attributed to 100G strength (despite dwindling revenues for optical storage lasers). And even though companies like Nokia (Helsinki, Finland) see a shortterm drop in wireless markets because of 4G reaching its peak,46 it points out that 5G wireless—and the backhaul fiberoptic cable and telecom laser equipment that supports its bandwidth expansion—is expected to roll out in 2020, no doubt creating another demand cycle for wireline infrastructure that will benefit nextgeneration communication laser sales.

Beyond the obvious strength in 100G markets as evidenced by the May 2016 acquisition of Menara Networks (Dallas, TX) by IPG Photonics (Oxford, MA) specifically for Menara's 100G/400G optical pluggable market presence,47 growing maturity in silicon photonics/integrated optoelectronics architectures and increasing applications for verticalcavity surfaceemitting lasers (VCSELs) are among the trends driving additional communicationsrelated M&A activity.

In August 2016, Juniper Networks (Sunnyvale, CA), with 3% yearoveryear net revenue growth to $1.285 billion in calendar Q3 2016, acquired Aurrion (Santa Barbara, CA) for its indium phosphide (InP)based silicon photonics expertise.48 Still the holy grail of optical communications, silicon photonics offers "dramatically lower cost per bitpersecond for networking systems, higher capacities for networking interfaces, and greater flexibility in how bandwidth carried on light is processed inside the electronic portions of networking systems," according to a blog post49 by Juniper founder Pradeep Sindhu.

Communications & optical storage

Includes all laser diodes used in telecommunications, data communications, and optical storage applications, including pumps for optical amplifiers.

Communications lasers had a great year in 2016, as there was a strong push by carriers around the world to upgrade their networks with 100G transceivers. Upgrades to new transmission levels always seems to occur in waves, with 2016 being the year many thought 100G became economically feasible. While the upgrade to 100G is today all related to wired networks, wireless operators are also preparing their networks to handle the newest 5G cellular technology, which is expected to start rolling out in 2020.

The prospects continue to dim for optical storage lasers. DVD, CD, and Bluray media sales continue to drop, and more cloudbased solutions are eliminating the need for large local storage. Heatassisted magnetic recording (HAMR), which uses a laser to increase storage capacity of magnetic media, has been pushed back again, with Seagate 16 TB 3.5 in. HAMR drives now expected to hit the market in 2018—a year ahead of Western Digital and Toshiba.

Also in the silicon photonics space, POET Technologies (Toronto, ON, Canada) acquired DenseLight Semiconductors (Singapore) for its IIIV integrated technologies and closed its acquisition of BB Photonics (Flemington, NJ) for $1.55 million in June 2016 to use BB's embedded dielectric technology to enable onchip athermal wavelength control and lower the total solution cost of datacenter photonic integrated circuits (PICs).50 In the first half of 2016, POET reached revenues of nearly $577,000 primarily from DenseLight products, and expects to reach $2 million in the second half.

But while an endtoend silicon photonics platform is still viewed as the future of communications technology, VCSELs are very much in the present. Since entering the 850 nm VCSEL business in 1998 to primarily serve highspeed datacom and sensing markets and then expanding into 1310 nm VCSEL production for HDTV, home networking, Fibre Channel, and Ethernet as well as metro telecom applications, Finisar (Sunnyvale, CA) has shipped more than 150 million VCSELs,51 contributing to its record sales of $341.3 million for the quarter ended July 31, 2016—a 7.1% increase over the prior quarter.

In September 2016, Finisar and Lumentum (Milpitas, CA) demonstrated interoperability52 of their 100G SWDM4 (shortwave wavelengthdivision multiplexing) optical transceiversSWDM typically geared for shortrun or datacenter interconnects over duplex multimode fiber using VCSELs at slightly different wavelengths around the 850 nm window. As reported on October 1, 2016, Lumentum telecom, datacom, and commercial laser—including VCSEL—revenue was up 25%, 24%, and 12% yearoveryear, respectively.

Having pioneered VCSEL arrays for timeofflight and 3D depth imaging, Philips Photonics (Ulm, Germany), a wholly owned business of Royal Philips, announced in November 2016 that it is doubling capacity at its laser diode manufacturing facility in Ulm and adding stateoftheart automation equipment to principally support the myriad demands for VCSELs.

And with its acquisition of Epiworks (Champaign, IL) and Anadigics (Warren, NJ) in early 2016 for $110 million, semiconductor laser manufacturer IIVI (Saxonburg, PA) is also looking to capitalize on the growing applications base for VCSEL products in consumer electronics, datacenters, sensing, medical, and industrial markets with expected VCSEL sales growth of more than 20% per year.53 Of Anadigics specifically,54 IIVI said, "The acquisition of this foundry adds capacity more quickly and economically than building it new ... and positioning II-VI as the world leader in VCSEL technology." Clearly, M&A activity in the communications sector is speeding timetomarket for certain highvalue laser technologies.

Scientific research and military

Even though the 2016 Global R&D Funding Forecast55 reports that US R&D spending will increase 3.4% to $514 billion, the Trump presidency is spurring headlines similar to this one from physicsworld.com: "Trump election shock threatens U.S. science,"56 detailing how the new administration already views climate change as a hoax and will support the fossilfuel industry over renewable energy initiatives.

Hopefully, the checks and balances of government (and the Internet) will favor science (and lasers). Already, in an MSN news brief,57 Trump appears to be "less critical of the Paris climate accord."

A 2014 Nature article58 reminds us that China is expected to outspend the US on science R&D by 2020. And in a June 2016 news story from Nature entitled "China by the Numbers,"59 author Richard Van Noorden says that China now invests more than 2% of its gross domestic product on R&D—a larger percentage than even the European Union—and points out a number of 'world's best' scientific achievements in China, including the world's longest experimental quantum communications network from Beijing to Shanghai as well as a significant rise in the number of published research papers.60

Laser sales for R&D applications will trend similarly to the global R&D spending rate of 3.5% in 2016, growing at a slightly better 4.2% to 471.4 million in 2016 compared to 2015. Companies like NKT Photonics (Birkerød, Denmark), who acquired Fianium (Southampton, England) for around $29 million in early 2016 to strengthen its position in ultrafast fiber lasers and supercontinuum lasers for scientific and metrology markets,61 is betting on a strong—or at least slow and steady— R&D growth market to solidify future sales. The military segment, however, offers a brighter laser future.

For 2016, laser spending in the military segment reached $406.0 million, a 9.4% increase over 2015 spending levels amid improved demand for laserbased military technology. Overall, the Stockholm International Peace Research Institute (SIPRI) reported that global military spending increased by 1% in 201562 to $1.6 trillion, marking the first increase since 2011.

Scientific research & military

Includes lasers used for fundamental research and development, such as by universities and national laboratories, and new and existing military applications, such as rangefinders, illuminators, infrared countermeasures, and directedenergy weapons research.

With research and development spending quickly approaching that of the United States, China's R&D programs show no sign of slowing. In North America and Europe, scientific research expenditure growth is slowing in kind with GDP. Despite these changes, research spending on lasers has tended to increase as a percentage of all research spending. Laser research spending on transportation, lighting, military, materials processing, and medical research are all increasing.

Overall military laser spending was strong this year, with most lasers being used for gun sights, imaging, ranging, and communications applications. Laser directedenergy weapons at this point are still being developed, but QCLs used for IR countermeasure systems have growing revenues as Northrop Grumman continues to receive new orders for its Common Infrared Countermeasures (CIRCM) systems for light aircraft. In the U.S., uncertainties are magnified as a new president takes office.

Defenselaserbased growth rates are even better than overall military spending, as evidenced by progress in a few key technology areas. The National Defense Industry Association (NDIA; Arlington, VA) says that directedenergy weapons are gaining traction63 across the U.S. military, and that investments in directed energy grew 23% in fiscal 2015 compared to the previous fouryear average, reaching $600 million. And infrared countermeasures are enjoying robust sales: Elbit Systems (Haifa, Israel) is headed into its second year of deliveries on a $26.5 million contract64 to supply fiberlaserdirected multispectral IRCMs for widebody jets, and Northrop Grumman (Falls Church, VA) is moving forward with its $35 million quantum cascade laser (QCL) based Common Infrared Countermeasure (CIRCM) program.65

The midyear 2016 acquisitions66 of Kent Periscopes (St Asaph, Wales) and solidstate laser maker Alfalight (Madison, WI) by Gooch & Housego (G&H; Ilminster, England) will allow G&H, according to its CEO Mark Webster, to "meet our strategic aims of moving up the value chain and diversification through increasing our footprint in the aerospace and defense sector." Even though G&H said that its Aerospace & Defense sales—comprising 21% of its total halfyear revenue of nearly $48 million for the period ended March 31, 2016—were down in the first half of 2016, they expect this sector to recover in the second half.

Han's Laser (Shenzhen, China) is branching out from its industrial laser roots into aerospace and defenserelated assembly equipment through its early 2016 acquisition of a large stake in Aritex (Badalona, Spain). Han's Laser also acquired CorActive (Quebec City, QC, Canada) in November 2016 to improve its capabilities in fiber lasers67 and specialty optical fiber markets.

Consequently, Chinese companies continue to make inroads into highpower fiber laser manufacturing, encroaching upon a onceexclusively European and North Americansupplied product. Raycus (Wuhan, China) advertises up to 10 kW fiber lasers and in November 2016, the Fourth Research Institute of China Aerospace Science and Industry Corporation (Beijing, China) announced that it had developed a 20 kW fiber laser.68

Medical and aesthetic

2016 was a very good year for aesthetic laser sales. Lumenis (Yokneam, Israel)which calls itself the world's largest energybased medical device company for surgical, aesthetic, and ophthalmic applicationssaw its 8th consecutive quarter of yearoveryear revenue growth of 9.3% in Q2 2014 to $72.5 million. Needless to say, Lumenis was acquired in 201569 by global alternative investment firm XIO Group (London, England) for $510 million and financial transparency now appears to be nonexistent.

Offering its pulse family of holmium lasers for treating 70 urology conditions, intense pulsed light (IPL) technology for dry eye and rosacea, OtoLase for middleear surgery, and fractional CO2 lasers for dermatitis and ENT conditions, Lumenis seems to offer a laser for nearly any medical condition. In addition, the Lumenis AcuPulse DUO CO2 laser for Transoral Laser Microsurgery (TLM) is a firstline treatment for early stage airway cancers with excellent cure rates compared to chemoradiation.

Medical & aesthetic

Includes all lasers used for ophthalmology (including refractive surgery and photocoagulation), surgical, dental, therapeutic, skin, hair, and other cosmetic applications.

In 2016, sales of lasers used for medical purposes hit record levels, as prices have come down and lasers are being adopted for more medical procedures. Strongest of all, with 18% revenue growth over a very strong 2015, was lasers used for aesthetic applications, including tattoo and wrinkle removal, body contouring, and skin resurfacing. After experiencing a loss in total revenue in 2015, revenue for lasers used to treat eye conditions returned to modest growth in 2016. Dental laser revenue growth, while still relatively small, also grew modestly in 2016 as more and more dentists adopt laser technology in their practices. The only medical area to see a decline in laser revenue in 2016 was in the surgical laser area, and this was only because of the very high laser growth experienced in this area in 2015.

As with some other laser areas in the U.S., insurance reimbursements and health insurance in general remains in flux, and this has slowed laser purchases in the U.S., at least for lasers used for procedures that are typically covered by health insurance. Overall, most of the laser revenue growth in the medical areas has occurred in areas outside of the U.S.

With a nearly identical portfolio to Lumenis (with the exception of a prominent CO2 laser offering), Cynosure (Westford, MA) saw calendar Q3 2016 revenues soar to $106.4 million70a 36% increase from the same period in 2015. And similarly, Cutera's (Brisbane, CA) Q3 revenue for the same period rose 31% to $30.3 million71 compared to 2015.

On strong aesthetic laser sales alone, we forecast sales in the medical and aesthetic laser segment to grow from $838 to $958 million in 2017—a phenomenal 14.3%. Growth beyond 2017 may spike even more if companies like LISA Laser USA (Pleasanton, CA) are successful in incorporating their RevoLix laser products into robotassisted da Vinci Surgical Systems.72

The medical laser industry should also see more M&A activity. Already, Johnson & Johnson (J&J; New Brunswick, NJ) acquired Abbott Medical Optics (AMO; Santa Ana, CA) in September 2016 for $4.3 billion—a roughly 4X multiple of AMO's $1.1 billion in sales in 2015 for its eye health, cataract surgery, and laser refractive surgery or LASIK expertise.73

While the dollar value of the acquisition represents only a small fraction of J&J's Q3 2016 sales of $17.8 billion, J&J's company chair of diabetes and eye health Ashley McEvoy alluded to the company's interest in ophthalmology by being "bullish on eye health"74 in a June 2016 preAMOacquisition interview by ois.net. Who knew that the value in femtosecond ophthalmic laser technology created by companies like IMRA back in the 1990s would be the subject of such intense M&A activity nearly 30 years later?

In this case, J&J has taken a rapid route to gaining LASIK and eye health expertise through acquisition, joining the likes of other LASIK providers like Carl Zeiss Meditec (Jena, Germany), whose Visumax Femtosecond Laseras proclaimed by at least one LASIK eye center75 "is the 'Mac Daddy' of lasers when it comes to Lasik surgery," working much faster than other lasers at just 1520 seconds per eye and making a much more precise "flap" that is centered perfectly on the cornea for ultraaccurate results.

Besides ophthalmology, other medical laser technologies have manifest in M&A actions and/or rapid sales growth: HIL Applied Medical (Jerusalem, Israel) acquired Nanolabz (Reno, NV) to commercialize laserassisted proton therapy for cancer.76 AMETEK (Berwyn, PA) acquired Laserage Technology Corporation (Waukegan, IL) to grow its presence in the medical industry through Laserage's laserbased fabrication and finishing of minimally invasive surgical devices, stents, and catheterbased delivery systems. And the cold laser painremoval devices and photodynamic cancerdestroying therapies from Theralase (Toronto, ON, Canada) led to a 14% increase in revenues77 for the ninemonth period ended September 30, 2016 compared to thesame period last year.

Instrumentation and sensors

The undeniable success of lidar technology and the M&A surge surrounding it is one of the biggest instrumentation and sensing stories of 2016. But laserbased structural health monitoring is also growing in importance for aircraft, vehicles, bridges, railroads, roadways, and any number of critical transportation and infrastructure assets worldwide.

In August 2016, U.S. Naval Research Laboratory (NRL) scientists successfully detected acoustic emission from cracks in riveted lap joints using a distributedfeedback fiber laseracoustic emission sensor.78 The in situ capability surpasses that of piezoelectric techniques and can be combined or 'multiplexed' with existing fiberoptic strain and temperaturesensing systems.

Instrumentation & sensors

Includes lasers used within biomedical instruments; analytical instruments (such as spectroscopy); wafer and mask inspection; metrology; levelers; optical mice; gesture recognition; lidar; barcode readers; and other sensors.

The laser instrumentation and sensors category includes a variety of applications that are becoming increasingly important in several important areas. Lidar in selfdriving vehicles seems to get all the attention, but lidar is also an important technology used in industrial and military vehicles with drones, and to increase efficiency at wind farms. Other types of laserbased sensors are being used increasingly in homeland security applications and in other types of monitoring applications, where reduced staffing levels have necessitated automated types of monitoring.

Other types of instrumentation and sensors are being used more often as more products become "smart" and rely upon automation, and this is especially true with the use of lowcost, laser diodebased sensors, with the simplest singlelaser lidar sensors now available for well under $10 each. Another growing area for laser sensors is for quality control in both additive and subtractive manufacturing applications.

Typically known for its fiberopticbased sensing systems for downhole oil and gas monitoring applications, Opsens (Quebec City, QC, Canada) is taking structural health monitoring inside the human body. Its FDAcleared OptoWire II fiberoptic sensor is an optical guidewire that measures Fractional Flow Reserve ("FFR") to diagnose the severity of coronary stenosis for heart patients.

The company credits a tenfold increase in FFR sales (from $0.5 million in fiscal 2015 to $5.2 million in fiscal 2016) for its record $9.6 million in total sales79 for the year ended August 31, 2016.

Terahertzlaserbased instrumentation is also gaining commercial acceptance. TeraView (Cambridge, England) reportedly doubled its sales in 2016,80 driven by its TeraPulse terahertz imager and spectrometer and successful launch of its Electro Optical Terahertz Pulse Reflectometry systemthe EOTPR 5000for semiconductor packaging inspection. Terahertz and fiberoptic sensing systems manufacturer Luna Innovations (Roanoke, VA) saw sales grow from $28.6 million in 2015 to $43.3 million81 for the same ninemonth period ended September 30, 2016 on increasing demand for its ODiSI systems for the measurement of strain in composite materials.

Our 2017 forecast for lasers used in instrumentation and sensors is for $661 milliona significant 8.7% increase over the $608 million in sales seen in 2016. While the instrumentation and sensing segment is roughly twothirds the size of medical and aesthetic or research and military laser markets, it has tremendous potential to grow in value because of the sheer volume of sensingbased lasers needed for some of these autonomous or smart applications such as lidar.

We've already discussed the overwhelming amount of M&A activity in the lidar industry, but a related instrumentation sector is also in the spotlight for 2016: 3D laser scanning. You may have seen the PBS television show called Time Scanners, where lidar data is converted to a 3D image. The science is also applicable to manufacturing and metrology settingsconsidered somewhat as lidar on steroids. For example, FARO (Lake Mary, FL) just launched its lidar with High Speed Imaging (HSI) technology82 that is "capable of composing an image of 400 million pixels, [and] provides highresolution zoom capabilities on critical features."

FARO reported sales at $233.9 million for the nine months ended September 30, 2016 and only modest growth of 3.4% compared to the same period last year. In August 2016, FARO acquired Laser Projection Technologies (LPT; Londonderry, NH). Of the acquisition, again a purelaser play, FARO president and CEO Simon Raab said, "In addition to LPT's leading laser projection solutions,[83] we believe LPT's proprietary imaging laser photogrammetry and imaging laser radar technologies have tremendous potential to disrupt the market by establishing a new class of highspeed laser measurement with advanced 3D imaging capabilities and we will focus our integration efforts on rapidly leveraging this potential. This technology is thousands of times faster than currently available lidar products ... and incorporates a welldeveloped laser projection capability to guide assembly, making it a fully robotic, highspeed collaborative tool for manual or automated assembly and verification."

Entertainment, displays, and printing

In November 2016, Barco (Kortrijk, Belgium) lauded the superiority of RGBlit84 rearprojection displays (2X brightness, 2X contrast, 3X energy efficiency) compared to LEDlit displays, and in June 2016, announced that it was leading the digital cinema industry85 with 125 installations of flagship laser and laser phosphor projectors.

Barco competitor Christie (Cypress, CA), a wholly owned subsidiary of USHIO (Tokyo, Japan), is also gaining traction with selected laser cinema installations. In April 2016, another wholly owned USHIO company, Necsel (Milpitas, CA), acquired PDLD (Pennington, NJ). As a laser projection and lighting company, Necsel saw value86 in the stabilized, volumetric Bragg grating (VBG) laser diode technology of PDLD.

Entertainment, displays & printing

Includes lasers used for light shows, games, digital cinema, front and rear projectors, picoprojectors, and laser pointers. Also includes lasers for commercial prepress systems and photofinishing, as well as conventional laser printers for consumer and commercial applications.

While still relatively small when compared to some of the other laser segments, the entertainment and displays segment contains some very interesting and fastgrowing laser applications. One such area is laser projection, including the use of lasers in digital cinema projectors. Today, laser light sources are used in about 200 of the largest cinema projectors worldwide, with about 50 of the 150 largest IMAX projectors now being laserbased. In addition to these highprofile theaters, a cheaper type of laser light source called laser phosphor is being used in another 1500 theaters worldwide.

Laser printer revenues used in both home and commercial settings are decreasing even as the number of printers sold continues to decrease, as laser diode prices for these applications continue to fall.

In addition to strengthening its IP portfolio and being able to better serve bioinstrumentation and life sciences customers, Necsel chairman and CEO William Mackenzie said, "This acquisition ... also augments and strengthens our vertical integration to continue to serve the needs of our projection customers and enhance the global rollout of laser cinema. We are excited to join the companies together as it bolsters our vision to drive lasers to become as ubiquitous as lamps and LEDs, and to create with our customers the next generation of projection displays and life sciences products."

In the printing category, laser inkjet printer sales87 continue to increase, but revenues are decreasing because of falling prices for the laser diodes used. Nonetheless, manufacturers continue to seek new methods to utilize laser technology in both paper and textile/plastic/organic printing applications.

Although the computertoplate lithographic invention using ultrafast lasers called "MiraclePlate"88never did reach fruition, ultrashortpulse (USP) or ultrafast lasers are finding success in a different type of printing. "With the current trend of product differentiation, the need for ondemand inline printing for CPG [consumer packaged goods] and industrial products has become an urgent requirement," says Lincoln Laser (Phoenix, AZ) director of marketing and sales Bill Kuypers. "In addition, price pressures are increasing interest in a highspeed marking solution that doesn't require any consumables such as the ink that traditional inkjet printing requires. To this end, a large increase in demand has occurred for polygonal based scan heads paired with ultrashortpulse lasers that can print on a multitude of targets including plastic, paper, and metal."

Although the lasers used in the aforementioned applications are counted in the Marking category within the materials processing segment, the rising acceptance of these laserprinted methods in consumer markets is yet more testament to the longevity and adaptability of laser technology worldwide. Sales of lasers for entertainment, displays, and printing applications grew again in 2016 to $268 million and are forecast to grow 19% to $319 million in 2017, largely on increasing laser cinema installations.

The entertainment and displays category also includes some of the more interesting laser applications with potentially high volumes. Here are a few notable display and lightingrelated laser innovations in 2016: Blaze Laserlights89 project a bicycle symbol on the street to warn motorists of a bicyclist's presence on a dark road; lidarequipped, lightcarrying drones create optimum rim lighting for moviemakers;90 and the laser rat fence91 attempts to scare off rats and other pestsmenacing crops and gardens.

For the complete list of references, please see http://bit.ly/2ivAnVK.